|

|

|

Select your vehicle to see available coverage options:

|

|

|||

|

|||

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Car Breakdown Compare: Coverage Guide for U.S. ConsumersExploring options for vehicle protection in the U.S. can be daunting, but understanding the intricacies of car breakdown coverage is essential for achieving peace of mind and cost savings. Whether you're driving through the bustling streets of Los Angeles or the serene landscapes of Pennsylvania, knowing what is covered under your car breakdown insurance is crucial. Understanding Car Breakdown CoverageCar breakdown coverage is designed to protect you against unexpected repair costs that can occur at any time. It typically includes towing, roadside assistance, and sometimes even rental car coverage while your vehicle is being repaired. What's Covered?

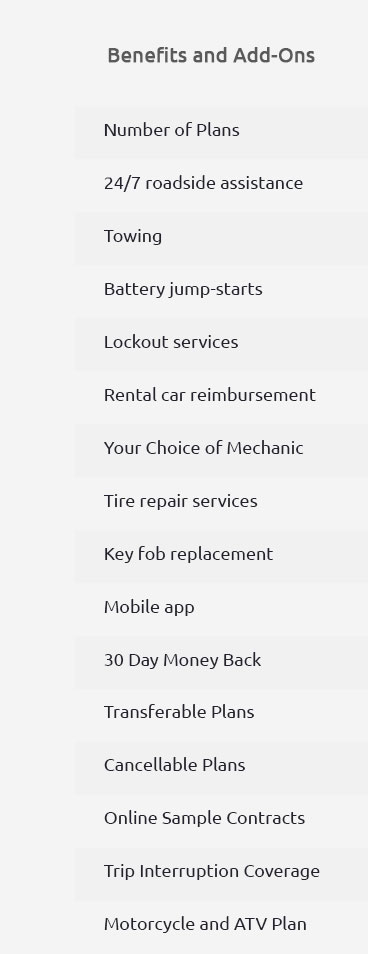

For more detailed information, consider checking out auto warranty companies in Pennsylvania that offer various coverage options tailored to local drivers. The Benefits of Extended Auto WarrantiesExtended auto warranties offer additional protection beyond the manufacturer's warranty, which can be a lifesaver for drivers of all types of vehicles, including luxury models like Lexus. Peace of MindKnowing that your vehicle is covered can alleviate stress and provide a sense of security as you navigate your daily commute or embark on a cross-country road trip. Cost SavingsPreventative maintenance and unexpected repairs can be costly. With an extended warranty, these expenses are often significantly reduced. For those interested in brand-specific coverage, exploring options such as auto warranty for Lexus might offer tailored plans that meet the unique needs of luxury car owners. Comparing Coverage PlansWhen comparing car breakdown coverage plans, consider the following factors:

FAQs About Car Breakdown CoverageWhat should I do if my car breaks down on the highway?First, ensure your safety by moving your vehicle to the side of the road if possible. Then, call your breakdown provider for assistance. How do I choose the right breakdown coverage?Consider your driving habits, the age of your vehicle, and your budget. Research different providers and read reviews to find a plan that suits your needs. Is breakdown coverage worth it for an older car?Yes, older cars are more prone to breakdowns, and coverage can help manage repair costs effectively. https://www.comparethemarket.com/car-insurance/content/with-breakdown-cover/

Temporary car insurance, fully comprehensive, multi car insurance, pay as you go car insurance, gap insurance. https://www.motoringassist.com/breakdown-cover/price-comparison

Some breakdown cover companies simply won't come out if you run out of fuel, fill up with the wrong fuel, get a flat battery or lose your car keys (GEM Motoring ... https://www.uswitch.com/car-insurance/breakdown-cover/

What is included in my breakdown insurance? - What is breakdown insurance? - What is vehicle breakdown cover? - What is roadside assistance? - What ...

|